Not known Facts About Personal Loans Canada

Not known Facts About Personal Loans Canada

Blog Article

Things about Personal Loans Canada

Table of ContentsSome Ideas on Personal Loans Canada You Should KnowHow Personal Loans Canada can Save You Time, Stress, and Money.Some Known Details About Personal Loans Canada Everything about Personal Loans CanadaPersonal Loans Canada Fundamentals Explained

Allow's study what a personal financing actually is (and what it's not), the factors individuals utilize them, and exactly how you can cover those crazy emergency expenses without tackling the problem of debt. A personal financing is a round figure of cash you can obtain for. well, practically anything., however that's practically not a personal finance (Personal Loans Canada). Individual car loans are made via a real economic institutionlike a financial institution, credit report union or online lender.

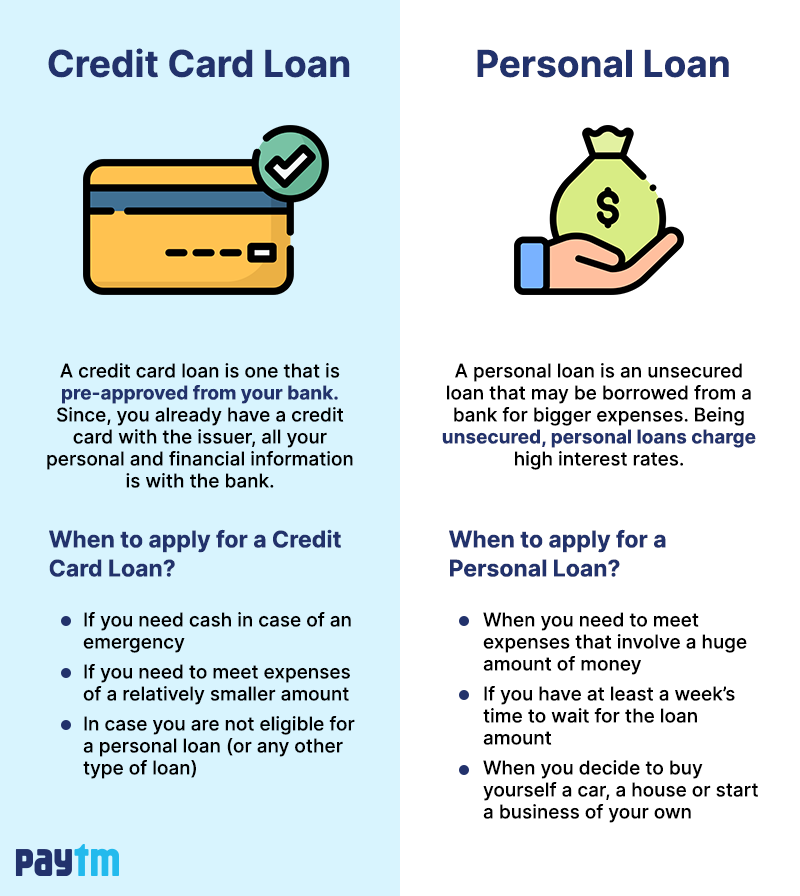

Allow's take a look at each so you can know specifically just how they workand why you don't require one. Ever before. A lot of personal finances are unsecured, which means there's no security (something to back the finance, like a vehicle or home). Unprotected lendings typically have greater rates of interest and call for a far better credit scores score since there's no physical product the lender can take away if you do not compensate.

10 Easy Facts About Personal Loans Canada Described

Shocked? That's all right. No matter how good your debt is, you'll still have to pay rate of interest on many personal financings. There's always a rate to spend for obtaining cash. Protected personal lendings, on the various other hand, have some kind of collateral to "secure" the funding, like a watercraft, precious jewelry or RVjust among others.

You might also secure a safeguarded individual funding using your automobile as security. That's a hazardous step! You do not desire your main mode of transport to and from work getting repo'ed since you're still spending for last year's cooking area remodel. Trust us, there's nothing safe about protected finances.

Yet even if the settlements are foreseeable, it doesn't indicate this is a bargain. Like we claimed in the past, you're basically guaranteed to pay interest on an individual loan. Simply do the math: You'll wind up paying method extra over time by getting a funding than if you would certainly simply paid with cash money

The Best Strategy To Use For Personal Loans Canada

And you're the fish hanging on a line. An installment funding is a personal lending you repay in fixed installments with time (typically once a month) up until it's paid completely - Personal Loans Canada. And do not miss this: You have to pay back the initial loan quantity before you can borrow anything else

Don't be mistaken: This isn't the same as a debt card. With individual lines of credit report, you're paying interest on the loaneven if you pay on time.

This obtains us irritated up. Why? Since these organizations victimize individuals that can't pay their bills. Which's just wrong. Technically, these are check short-term financings that provide you your paycheck in advancement. That might seem confident when you remain in a financial accident and require some money to cover your expenses.

The Personal Loans Canada PDFs

Why? Because things obtain actual messy genuine fast when you miss a repayment. Those financial institutions will come after your wonderful granny that guaranteed the lending for you. Oh, and you ought to never ever cosign a loan for anybody else either! Not only could you get stuck with a car loan that was never ever suggested to be yours to begin with, however it'll spoil the connection before you can claim "pay up." Count on us, you don't want to be on either side of this sticky circumstance.

All you're truly doing is utilizing brand-new financial debt to pay off old financial debt (and extending your loan term). Firms know that toowhich is precisely why so several of them provide you consolidation loans.

And it begins with not borrowing any even more cash. Whether you're assuming of taking out a personal finance to cover that kitchen area remodel or your frustrating credit history card bills. Taking out debt to pay for things isn't the method to go.

Not known Facts About Personal Loans Canada

And if you're thinking about an individual funding to cover an emergency, we get it. Borrowing money to pay for an emergency situation just intensifies the anxiety and difficulty of the situation.

Report this page